Preface

Germany has been performing as Europe’s profitable hustler for the once many decades as a result of its well-developed and robust business terrain and infrastructural development in the field of entrepreneurship and inventions. These inventions and infrastructural development are well-defended and invested in by the country’s government regularly.

Still, when it comes to laying down a foundation for a new tech incipiency or an association fastening on a particular section of society the companies operating within the borders of Germany navigate a complex web of levies and regulations that are well set and planned by the German government.

These taxation rules and regulations must be followed by any incipiency that’s seeking to establish a foundation within the country’s boundary and the association must abide by all the taxation laws as set by the German government to serve well and without any legal issues over the long run.

This textbook will deeply explore the tax web and regulations set up by the German government with the help of essential statistics and business understanding developed as a result of well worst exploration of the taxation geography prevailing within the nation’s boundary. We’ll also have a deeper look at tax reduction programs in Germany leading to a well-clued and planned structure for tax obligations for companies in Germany.

Commercial income tax and trade levies

1. The commercial income tax (CIT)

Christian Lindner, was a general politician and the leader of the Free Democratic Party (FDP) in Germany. Generally, advocate for policies that support free market and individual freedoms. They also focus on tax reduction and bureaucracy to increase economic conditions and encourage entrepreneurship. The German government has decided to put commercial income levies on gains earned by companies that are performing within the nation’s boundaries and under the surveillance of the German government.

This tax is only charged on gains earned by the company within One fiscal time and not on total expenditure performed by the company is taken into account fuller stock of the overall investments and the overall expenditures once abated from one another gives the overall profit tax is charged on this profit periphery depending upon the region and the area of performing that the company leverages on.

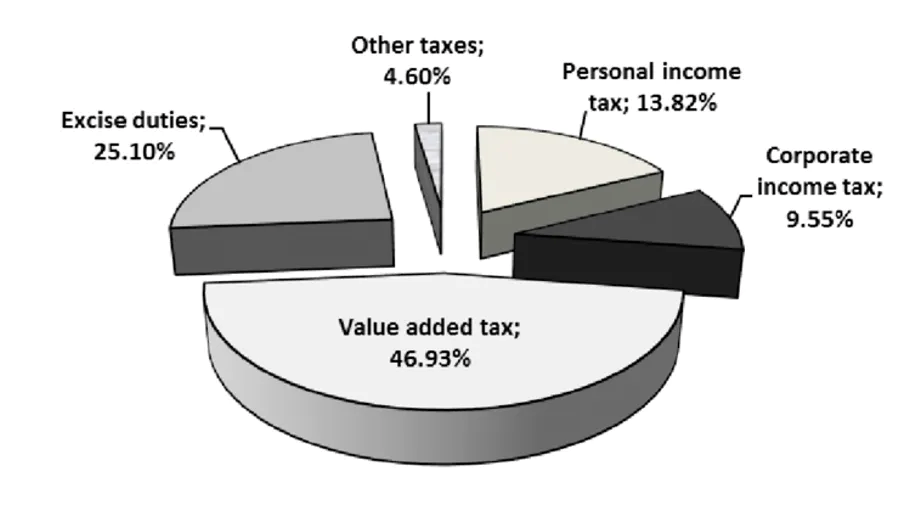

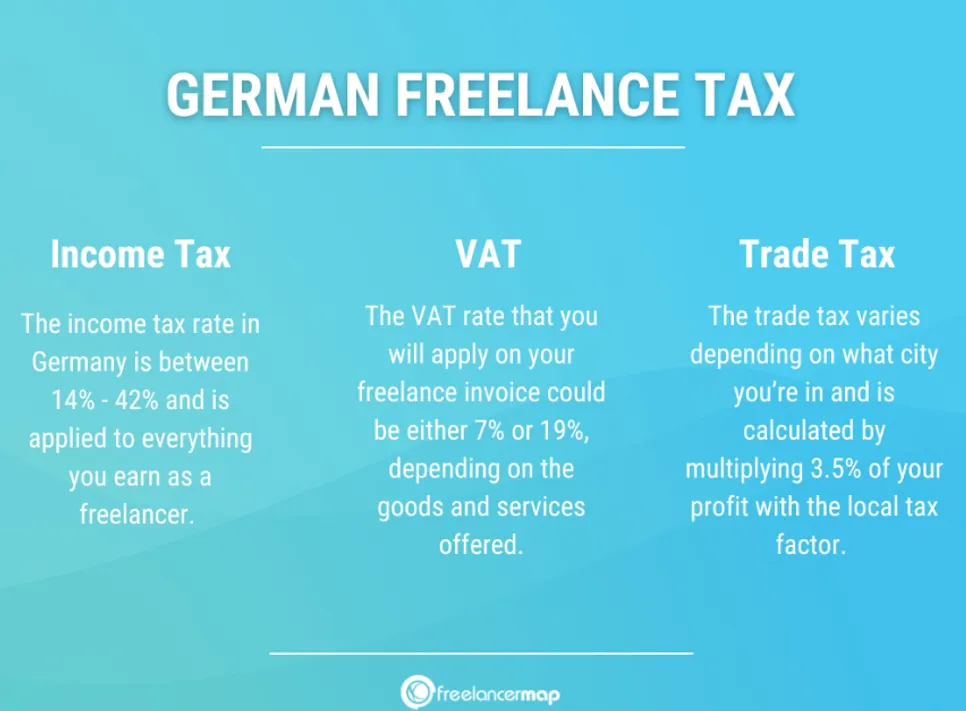

On a standard base, the CIT rate is fixed at 15 and a solidarity cargo of 5.5 is assessed on the CIT quantum performing in an effective CIT rate of 15.825/ 1 fiscal time.

These levies are to be properly paid by any incipiency or company that seeks better legal vittles and full government subventions in the German nation. Also, one further relaxation or rather regulation is assessed by the German government that easily states that German commercial income tax is applied to worldwide income attained by the resident company.

All the non-resident foreign companies are only subordinated to CIT on the income deduced from the German sources and the income deduced from the transnational sources is left free and out of the bounds of the commercial income tax.

2. The trade tax

Tax reduction programs in Germany have also had a great impact on the trade levies assessed by the German government on both native and non-native companies. The tax obligation for companies in Germany in the field of trade is enforced and subordinated to the external position.

The trade levies and the tax obligation for companies in Germany over the field of the work and region of sighting are decided between the rates ranging from 7 to 17.75. The rates are properly decided by the German government and the external pots depending upon the area in the region where the foundations of the company are laid.

The tax reduction programs in Germany are July enforced in CIT and trade levies by the external ports and the German government.

3. The value-added tax

The value-added tax generally known as Handbasket is also considered among the colorful tax reduction programs in Germany and has been properly amended by the German government within the once many times. Tax obligations for companies in Germany in the field of value-added tax are generally fixed at the rate of 19 on utmost goods and services. Colorful rudiments similar to food and books face a relatively lower Handbasket taxation that’s reduced to 7 as compared to gratuitous and luxurious particulars.

The tax reduction policy in Germany substantially focuses on the perpetration and well employing of the rudiments and charging luxurious cultures a bit lesser quantum of tax. This policy can be imaged from the Handbasket taxation policy enforced by the German government as the rudiments and the diurnal essentials are tagged at a lower rate when compared with other luxurious goods and services.

Tax obligations for companies in Germany that are performing in the field of serving luxury cultures to individualities are more complex when compared to those associations that concentrate on serving rudiments and diurnal essentials. Companies or associations with a periodic development exceeding€ 22,000 are needed to register for Handbasket taxation.

The recent developments In taxation programs

1. The digital tax

With the rise in technology around the globe the tax obligation for companies in Germany that are performing in the Department of digital service provision are enforced by the German government. The tax reduction programs in Germany have diverted their attention from offline selling levies towards the digital sphere as well within the end of the former time. Exploring and enforcing DST that is digital service tax all over Europe is also enforced and seen by the German government.

The rising eventuality of the digital disciplines of service provision has attracted the German government’s attention to the challenges posed by digital frugality in a contest of taxation and maintaining the tax rules. The tax reduction programs have offered companies that perform and work in the field of largely transubstantiating digital revolution to pay levies in an accessible way and at a lower rate when compared to the ongoing offline service providers.

2. The commercial tax reforms

The tax reduction programs in Germany have now concentrated on exploration and development as a major hey need for the rapid-fire development of the nation’s frugality and educational structure. As a result tax obligations for companies in Germany that concentrate on the exploration and invention sector are reduced by the German government under the invention incitement scheme.

This scheme provides companies with fresh deductions to qualify expenditures and establish a well and secure profitable base for their company to grow. Also, the German government and the tax reduction programs in Germany have shifted their attention towards aggressive tax planning performed by the companies. The German programs have enforced anti-tax avoidance directives into its tax laws that have concentrated and maintained well and smooth discovery and avoidance of aggressive planning done by the collaborative companies to pay their levies and avoid some at the same time.

Data published by the Federal Statistical Office of Germany stated that the commercial tax profit quantum was roughly 106.1 billion euros. This data states the part of service providers and companies towards the country’s tax resources that have led to the rapid-fire development of the German nation.

Conclusion

As the mortal race is moving and evolving towards a digital age tax reduction programs in Germany are being assessed by the German government for stock as an outgrowth the tax obligation for companies in Germany has been reduced to a significant and considerable position.

The German government and its programs are now fastening on a better exploration and innovative terrain for new-age businesses to grow and develop within the nation’s boundaries. Colorful reforms have been initiated by the government to give great profitable support to these well-developing and still-developing startups in the nation.

These reforms and tax reduction programs in Germany may feel insignificant for the present time development rates prevailing within the nation but in the long run after the businesses and inventions are established they can contribute significantly towards the exponential and rapid-fire growth of the country’s overall GDP at the global position.