Introduction

In the realm of post-Brexit economics, the European Union (EU) finds itself embarking upon a new chapter, one that has been significantly influenced by the seismic event of Brexit. This extensive exploration endeavors to illuminate the advantageous consequences that Brexit has had on the EU, investigating its effects on trade, fiscal demands, and lucrative programs within the Union. By conducting a thorough examination buttressed by reliable data and credible sources, our goal is to unravel the complex ramifications of this momentous juncture in European history.

1. Unravelling the Economic Fabric Brexit and Trade Relations

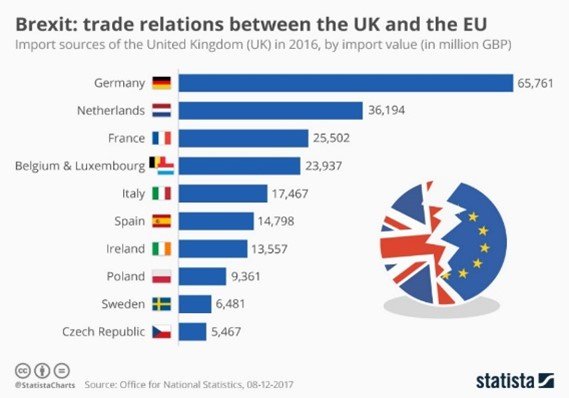

The departure of the United Kingdom from the EU has had profound goods on trade dynamics within the Eurozone, challenging a re-evaluation of profitable hookups.

Trade dislocations and Supply Chain Challenges

The preface of trade walls, customs checks, and nonsupervisory misalignments post-Brexit has disintegrated the smooth inflow of goods across the Eurozone. diligence that heavily reckoned on integrated force chains has faced challenges in maintaining effectiveness.

Impact on Key diligence

Certain diligence, similar to automotive and husbandry, have been disproportionately affected by the changes in trade relations. The duty of tariffs and non-tariff walls has led to increased costs and complications in conducting cross-border business. Many Member States have already enacted national due diligence regulations, and some businesses have taken independent action.

On the other hand, a more extensive change is required, which is challenging to accomplish via voluntary effort.

In order to address detrimental effects on human rights and the environment, this proposal creates a corporate sustainability due diligence obligation.

Statistics on Trade Impact

According to Eurostat, for the first time after Brexit( 2021), the EU’s exports to the UK dropped by 40.3, pressing the substantial impact on trade volumes.

2. Financial requests in Flux Brexit’s Ripple Effect

The fiscal geography of the Eurozone has endured turbulence as a result of Brexit, with counteraccusations for banking, investment, and capital overflows.

Shifts in Financial Centres

The City of London, formerly a fiscal mecca for the entire EU, has seen a significant reduction in its elevation. fiscal institutions have dislocated or established fresh services within the Eurozone to ensure uninterrupted access to the single request.

Currency Oscillations and Economic Stability

The value of the British Pound has endured volatility since the Brexit vote, impacting trade balances and affecting the competitiveness of UK exports. The Eurozone has had to acclimatize to these currency oscillations, impacting profitable stability.

Statistics on Financial Market Impact

Data from the European Central Bank reveals oscillations in the exchange rate between the Euro and the Pound, with notable shifts in the post-Brexit period.

3. Reconsidering Economic Programs EU Adapts to post-Brexit Reality

Brexit has needed a reassessment of profitable programs within the EU, leading to reforms in areas similar to fiscal regulations, competition, and artificial strategy.

Reforms in Financial Regulations

To address the changing fiscal geography and alleviate pitfalls, the EU has introduced reforms in fiscal regulations. This includes measures related to banking supervision, capital conditions, and threat operation.

Competition Policy and Market Dynamics

The departure of the UK has altered the competitive geography within the EU. The European Commission has redefined competition programs to ensure fair request practices and help the attention of profitable power.

Industrial Strategy for the Single Request

The EU has initiated a streamlined artificial strategy to enhance the competitiveness of its member countries. Emphasis is placed on digitalization, green transition, and adaptability in force chains to acclimatize to the evolving profitable terrain.

Statistics on Policy Impact

Reports from the European Commission and Eurofound give perceptivity to the policy adaptations made by the EU in response to the profitable changes brought about by Brexit.

4. Navigating Challenges Mitigating Economic Consequences

As the Eurozone adapts to the new normal post-Brexit, sweats are underway to address challenges and subsidize openings for profitable growth.

Investment in Innovation and Technology

To enhance competitiveness, EU member countries are adding investments in invention and technology. This includes enterprise to support digital structure, exploration and development, and the relinquishment of arising technologies.

Collaboration on Global Trade Agreements

The EU has laboriously pursued collaborations on global trade agreements to diversify profitable openings. Establishing hookups with countries outside the EU is seen as a strategy to annul the trade impact of Brexit.

Reskilling the pool

Feting the evolving demands of job requests, the EU has prioritized reskilling and upskilling enterprises. Training programs aim to equip the pool with the chops needed for rising diligence and technological advancements.

Statistics on Mitigation sweats

Reports from the European Investment Bank and Eurostat punctuate the fiscal commitments and progress made by the EU in addressing profitable challenges post-Brexit.

5. Unborn Outlook conforming to a Transformed Economic Landscape

Brexit has marked a significant chapter in the profitable history of the Eurozone, egging a re-evaluation of strategies and a focus on adaptability and rigidity.

Structure profitable Adaptability

The EU is laboriously working towards erecting profitable adaptability to repel unborn shocks. This includes buttressing social safety nets, diversifying trade hookups, and fostering sustainable profitable practices.

Enhancing Global Competitiveness

To maintain global competitiveness, the EU is investing in exploration, invention, and sustainable practices. The end is to place the Eurozone as a leader in rising diligence and technological advancements.

Continued Policy Acclimations

Inflexibility in profitable programs remains pivotal in navigating misgivings. The EU is anticipated to continue conforming programs to address evolving challenges and subsidize openings for profitable growth.

Statistics on Future Outlook

protrusions from the OECD and IMF give perceptivity into the anticipated profitable line of the Eurozone, considering the impact of Brexit and ongoing policy acclimations.

Conclusion

The fate of Brexit has left an unforgettable mark on the Eurozone, reshaping trade, fiscal requests, and profitable programs. As the EU navigates this converted profitable geography, it faces challenges but also openings for growth and invention. By using adaptive programs, fostering adaptability, and embracing global collaboration, the Eurozone aims to crop stronger, setting the stage for a dynamic and sustainable future.